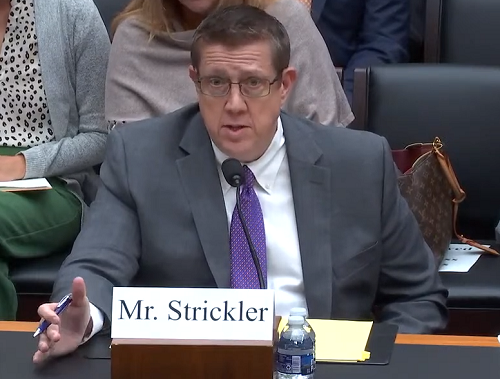

Kris Strickler (above), director of the Oregon Department of Transportation, recently outlined some of the solvency issues facing the Highway Trust and how his state is addressing them via a “user-pay” program during an October 18 subcommittee hearing before the House of Representatives Transportation and Infrastructure Committee.

[Above photo via the House T&I committee]

Testifying before the Subcommittee and Highways and Transit, Oregon DOT’s Strickler – joined at the witness table by Chad Shirley, Ph.D., principal analyst for the Microeconomics Studies Division within the Congressional Budget Office; Jeff Davis, senior fellow with the Eno Center for Transportation; and Reema Griffith, executive director, Washington State Transportation Commission – explained how tax revenues that have traditionally supported the Highway Trust Fund are no longer adequate to maintaining its solvency.

“The Highway Trust Fund serves as the primary mechanism by which the federal government provides resources to states, local governments, and transit agencies for highway and transit investments,” Strickler explained in his testimony.

“But the Trust Fund, once again, faces a fiscal cliff at the expiration of IIJA [Infrastructure Investment and Jobs Act]. Since 2008, revenues have not kept pace with the expenditures approved by Congress, and more than $275 billion has been transferred into the Trust Fund from the General Fund during this time,” he said.

“Why this happened is relatively straightforward as the purchasing power of Trust Fund revenues has declined substantially. Federal fuel taxes are flat, per-gallon excise taxes that have not been adjusted since 1993 and have, therefore, lost more than half of their value over the last 30 years,” Stickler pointed out. “While [federal fuel] taxes have not increased at all between 1993 and 2022, college tuition has gone up 463 percent and healthcare costs have gone up 280 percent. We need to find a long-term funding solution.”

To that end, Oregon has been experimenting with a user-pay approach for the last several years –a road-usage charge or RUC system that levies a fee based on how many miles a vehicle gets driven, rather than how much fuel is purchased per vehicle.

Strickler noted that Oregon launched the nation’s first RUC pilot project in 2006 and the first fully operational RUC program in 2015, known as “OReGO,” via which volunteers pay a per-mile charge and receive a credit for fuel taxes paid at the pump. In 2021, the Oregon DOT expanded the OreGO program to the city and county level as well.

“A RUC is a fair way to ensure that all vehicles pay for their use of the roads,” he explained. “We’ve seen data that rural residents tend to drive longer distances and use less fuel-efficient vehicles and thus pay more in [fuel] tax than their urban counterparts. However, under a RUC, rural residents likely wouldn’t pay much more than they do with a [fuel] tax, while urban residents—who tend to drive more efficient vehicles—would likely pay a little more.”

He stressed that participant privacy is a critical component of Oregon’s RUC program, as Oregon DOT “never receives location data on any vehicle” via the RUC system but rather receives only “aggregated and anonymized” data to use in its assessment of RUC fees.

“Our volunteers can choose a GPS-based or non-GPS options to help determine their road use,” Strickler said. “We have partnered with private sector account managers who are responsible for administering individual transactions, and by statute this data must be destroyed within 30 days of account settlement. Also, law enforcement must obtain a warrant to access the [RUC] data.”

Other state departments of transportation are experimenting with RUC-type programs as well.

The California Department of Transportation launched a RUC test program in 2021 – also referred to as a vehicle miles traveled or VMT tax or a mileage based user fee or MBUF system – that would serve as an alternative to the state’s motor fuel tax.

The California Road Charge Phased Demonstration explored ways to levy fees on drivers for the miles they travel rather than the gasoline they purchase and consume by testing a user-friendly pay-at-the-pump and electric vehicle charging station system, or through a usage-based insurance approach.

In 2022, the New Jersey Department of Transportation and the Eastern Transportation Coalition collaborated on a similarly-styled MBUF pilot program. The Eastern Transportation Coalition also issued a report that tallied up the results of previous MBUF pilot programs conducted over the course of 2020 and 2021 – a 108-page report focused on addressing concerns about privacy, rural drivers, and commercial trucking operations.

Patricia Hendren, the coalition’s executive director, noted that the report highlights the “feasibility” of an MBUF program as “a viable, scalable model for funding our nation’s highway infrastructure by addressing concerns around privacy and impact on all users, from rural to urban settings as well as cars and trucks.”

Top Stories

Top Stories

USDOT Issues $1B in Local Road Safety Funding

January 2, 2026 Top Stories

Top Stories