On May 23, the American Association of State Highway and Transportation Officials passed a resolution at its 2019 spring meeting in Park City, UT, that recommended four specific revenue-generation solutions for ensuring the solvency of the Highway Trust Fund.

Those suggestions are: an increase in the federal motor fuels tax that may include indexing the tax to inflation; taxing a barrel of oil, which builds off the model of the motor fuel tax, but would shift collection from individuals to producers of oil; instituting a freight-based user fee that would capture the impact from the movement of goods across the nation’s transportation system; developing a mileage-based user fee on vehicle travel that would insulate the HTF from “revenue dilution” stemming from increased vehicle fuel efficiency.

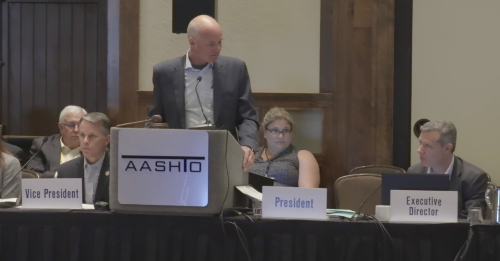

“One thing we are trying to do as an association is to offer up more specific guidance, suggestions, and advice to our friends and colleagues on Capitol Hill,” noted Patrick McKenna, director of the Missouri Department of Transportation and AASHTO’s 2018-2019 vice president, at the meeting.

“This is a resolution brought forward with strong consensus,” he added. “Ultimately what we are trying to do is something different; we are trying to hone the list of potential funding sources down.”

McKenna noted that a “matrix” of possible funding solutions originally compiled by AASHTO nearly five years ago “have not born fruit in terms of generating more transportation funding. So we wanted to forward a narrower list of user fees that offer a good way to fund transportation and produce significant revenue, but also things that can be implemented reasonably and at reasonable cost.”

Jim Tymon, AASHTO’s executive director, added that “when we attend meetings on Capitol Hill, we get asked, ‘what specific revenue solutions do you support?’ And there’s a sense of urgency now especially as Senate and the House are speeding up their focus on [surface transportation funding] reauthorization. We felt that, to be at the table, it would helpful to have a narrower list of potential [revenue] options that we support.”